Brief from the Research Canada: An Alliance for Health Discovery

A Two-Pronged Approach to Canada’s Future Prosperity

Research Canada's Members

- Alberta Health Services

- Baycrest Centre for Geriatric Care

- Bioniche Life Sciences Inc.

- BIOTECanada

- Canada's Research-Based Pharmaceutical Companies

- Canadian Association of Occupational Therapists

- Cystic Fibrosis Canada

- Canadian Foundation for Dental Hygiene Research and Education

- Canadian Healthcare Association

- Canadian Pain Society

- Canadian Physiotherapy Association

- Canadian Society of Biochemistry, Molecular & Cellular Biology

- Canadian Society for Immunology

- Capital District Health Authority

- Centre for Addiction and Mental Health Research

- Centre Hospitalier Universitaire de Québec – Research Centre

- Centre Hospitalier Universitaire de Sherbrooke – Research Centre

- Child & Family Research Institute

- Children’s Hospital of Eastern Ontario (CHEO) Research Institute

- College of Family Physicians of Canada

- Council for Canadian Child Health Research

- Covenant Health Research Centre

- Douglas Mental Health University Institute

- Fisher Scientific Canada

- Friends of CIHR

- General Electric Health Care, Canada

- Hôpital Sainte-Justine Research Centre

- Hospital for Sick Children Research Institute

- Infectious Diseases Research Center of Laval University

- IWK Health Centre

- Juvenile Diabetes Research Foundation

- Kingston General Hospital

- Lawson Health Research Institute

- Leukemia & Lymphoma Society of Canada

- March of Dimes Canada

- McGill University Health Centre Research Institute

- McMaster University

- Montreal Heart Institute

- Newfoundland and Labrador Centre for Applied Health Research

- Ontario Neurotrauma Foundation

- Ottawa Centre for Research and Innovation

- Ottawa Hospital Research Institute

- Pan Provincial Vaccine Enterprise (PREVENT)

- Parkinson Society Canada

- Providence Health Care Research Institute

- Provincial Health Services Authority

- Queen’s University Faculty of Health Sciences

- Samuel Lunenfeld Research Institute

- Sanofi Pasteur Limited

- Schizophrenia Society of Canada

- Sunnybrook Health Sciences Centre

- The Royal College of Physicians and Surgeons of Canada

- Thunder Bay Regional Health Sciences Centre

- Toronto Rehabilitation Institute

- University Health Network

- University of Manitoba Faculty of Medicine

- University of New Brunswick

- University of Ottawa Heart Institute

- University of Toronto Faculty of Medicine

- University of Western Ontario

- uOttawa Institute of Mental Health Research

- Vancouver Coastal Health Research Institute

- York University

Research Canada's R7 Partners

- Association of Canadian Academic Healthcare Originations (ACAHO)

- Association Faculties of Medicine of Canada (AFMC)

- BIOTECanada

- Canada's Research-Based Pharmaceutical Companies (Rx&D)

- Health Charities Coalition of Canada (HCCC)

- Canada’s Medical Device Technology Companies (MEDEC)

About Research Canada

The Mission of Research Canada: An Alliance for Health Discovery is to improve the health and prosperity of Canadians by championing Canada’s global leadership in health research.

Research Canada is a not-for-profit, voluntary organization that is a unifying national voice for health research advocacy in Canada. Working for all Canadians, its membership is drawn from all sectors dedicated to increasing investments in health research, including the leading health research institutes, national health charities, hospitals, regional health authorities, universities and private industry.

Reaching out to the Canadian public, the media and government, Research Canada informs and raises awareness of the critical importance of long-term, sustainable health research funding as an investment in Canada’s future. As an evidence-based organization, Research Canada also seeks and values Canadians’ views on the impact of health research. The organization has released two public opinion polls in 2006 and 2007 demonstrating the strong support of Canadians of Canadian health research.

Health research is critical for Canada for three reasons: it improves the health of Canadians, offers a real opportunity to contain health care costs, and contributes to the creation of knowledge-based jobs and economic growth.

Research Canada welcomes the opportunity to work with the government as it engages all sectors and works in partnership to build support for health research nationwide.

The Proposition*

Investments in health research proffer foundational support for sustained economic recovery in Canada, and will position our nation well in the evolving knowledge-based economies of our global partners. Research Canada posits that a two-pronged approach is necessary.

It is fundamental that the Government of Canada supports the entire cycle of R&D, from discovery, through to product development and commercialization, to the marketplace and to health-care settings. To ensure the nation’s capacity to best capitalize on its Investments throughout the innovation cycle, the government must balance these investments across the spectrum of activity.

Second, Canada should, in partnership and through collaborations among key public, private and academic stakeholders, capitalize on the new wave of outsourcing business models adopted by existing multinational enterprises (MNEs). It is as a consequence of this shifting playing field that the time for attracting MNEs to call Canada home is waning. Research Canada suggests that Canada will be best served by focussing on supporting vehicles that will accelerate the transition of technologies into start-ups and small and medium-sized enterprises (SMEs). This will serve two fundamental work products: the provision of receptors for, and continuity of training of high quality personnel, and an increasing ability to attract MNEs to do business in Canada motivated by their increasing demand for pipeline technologies and products.

In this context and throughout this submission, Research Canada’s views are informed by its partnership efforts with six other national health organizations that together comprise the R7.[1] The Prong Two section of this submission presents recommendations Research Canada recently provided to the Federal Expert Panel on R&D in Canada in collaboration with two of its R7 partners, the Association of Canadian Academic Healthcare Organizations (ACAHO) and the Association of Faculties of Medicine of Canada (AFMC).

Prong One

The cycle of innovation incorporates four major stages – research, development, market validation and delivery. And, it involves multiple players, including governments, academia, industry, not-for-profit organizations and, in the case of health, decision makers at all levels of the health system. Each of these stakeholders brings unique and essential resources to a robust innovation system and has a pivotal role to play.

We underscore that research is a long-term process; investments made today in discovery research may deliver their impacts years after the initial investment. The success of Canada’s innovation system over the long term is, therefore, highly dependent on today’s investments in discovery research. The most commercially successful products and services begin as an idea and, through an often unpredictable path of discovery, experimentation and hypothesis testing; eventually emerge as a commercial product.[2] Targeted investments in areas of immediate applications, commercial or otherwise, must be complimented by predictable and sustainable investments in discovery research that will profoundly increase our ability to create a sustainable pipeline.

Governments must play a foundational role through consistent and sufficient support of the discovery research that is fundamental to our capacity to innovate. With this in place, it is possible to create a national economic environment and strategy that enable the multi-sectoral partnerships required for a robust innovation enterprise which will, in turn, enhance R&D capacity and accelerate the translation of discovery research into both the health system and the global marketplace.

As an example and toward this end, the Strategy for Patient-Oriented Research, (SPOR) initiated by the Canadian Institutes of Health Research (CIHR) proposes a national and multi-sectoral partnership (the provinces, the private sector, the academic sector, health charities and health professionals) aimed at applying research advances in health care and the economy.

Further, CIHR has also established the Proof of Principle (PoP) program towards moving closer to closing the gaps that exist in the transition from discovery to product development. Research Canada supports the provision of ongoing, indeed additional funding, for such programs in order to better capitalize on our nation’s capacity to extract economic value and health utility from the federal investment in discovery research.

Resolve

The PoP program is an innovative approach to meeting the challenge of commercializing and mobilizing knowledge from research discoveries; at only $5.7 million in grants for successful applicants, however, it is far from adequate to meet even current needs. The program provides one-year grants to projects leading to products with a demonstrated market opportunity. A review of the structure, objectives and focus of the program by CIHR and an increase to $20 million over each of the next five years could significantly increase the discoveries that advance to the marketplace and into health systems.

To increase the effectiveness and outcomes of the program Research Canada recommends increasing its flexibility with regards to: the level and duration of investment in selected projects to better meet individual projects’ needs; releasing applicants from the requirement for a private-sector investor in the second phase of the program; and extending eligibility to university- and hospital-based technologies.

The success of programs such as PoP is rooted in large part to its role in catalyzing the creation of teams of academic researchers and those with professional business acumen with the private sector, both investors and existing companies. Research Canada encourages the Government of Canada to continue investing in programs which assist in developing these linkages.

Therefore, Research Canada recommends:

RECOMMENDATION 1: Budget 2012 supports an additional increase in the base budget of the Canadian Institutes of Health Research’s (CIHR) towards leveraging multi-sectoral support dedicated to accelerating the uptake of new knowledge/technology into the healthcare system and global marketplace.

Prong Two

A paradigm shift will underpin building a strong and sustainable economy in this country. Thus far, Canada has focussed largely on the creation and/or capture of MNEs in this country. As recently as this past year, Industry Canada charged the Federal Research and Development Expert Panel it struck to query why, given the captive spending pool, does Canada lack a significant pharmaceutical/health products industry?

Research Canada suggests that as a nation, we should, in partnership and through collaborations among key public, private and academic stakeholders, capitalize on the new wave of outsourcing business models adopted by existing MNEs and move the country into this market place where accelerating the transition of technologies into start-ups and SMEs is the future of our economic success.

MNEs in the pharmaceutical and biotechnology industries are ever shifting to public sector partnerships focused on ensuring the scope and depth of their innovation pipelines. This restructuring is motivated by a number of related issues including and most notably, at the front end, the failure of their traditional internal R&D efforts to produce the next generation of blockbuster drugs that has been exacerbated by patent expirations. This has accelerated their consolidation of programs, sunset of ineffective programs, a refocus on the identification of new disease areas of interest, and established partnerships with the public sector towards ensuring scope and depth in pipeline activities. (See Appendix 1)

This trend is impacting big research organizations in the Boston area, for example, home to some of the best minds in drug development including: Pfizer's Global Centers for Therapeutic Innovation in Cambridge Massachusetts, has matched investigators from the pharmaceutical giant and academia to advance important new therapies. The company started with a collaborative initiative at the University of California, San Francisco and plans to expand this concept around the globe.

John Hennessy, Executive Director at AstraZeneca Boston indicated his company has downsized its R&D operations, recruiting new research leaders from outside the company to find fresh talent. AstraZeneca plans to source 40% of new programs from outside the walls of its R&D silos.

The question then becomes: How does the health research enterprise in Canada with its three core mandates and cognate markets[3] that are intertwined with provincial control of health spending make this paradigm shift?

Resolve

Research Canada suggests that a realignment of federal spending in health research would provide the opportunity to lay the foundation for an evolved national health system that is no longer a cost burden to the country but an economic engine paving the way for a healthy and prosperous future for Canadians. The economic engines of the future are the world’s knowledge-based industries. The health system in Canada is our largest knowledge-based sector employing hundreds of thousands of Canadians and emerging as the largest and most important driver of the global economy.[4]

We can learn from our international partners in this regard. The US is taking an approach that Canada may wish to consider. The NIH is aggressively pursuing a strategy to enable a national network of health translation units (National Centre for Advancing Translational Sciences/NCATS[5]), with the aim of ramping up the commercial application of health-related research. Similar strategies are being rolled out in the UK and EU.

By aligning current federal funding instruments to enhance research implementation, Industry Canada has the opportunity to create a Canadian Commercialization Network (CCN). This network would be the engine of regional small business creation and positioned to partner with the Industrial sector, US NCATS and the EU initiatives.

The Centres of Excellence in Commercialization of Research (CECRs) are a good example of appropriate vehicles to form the regional cores required to run the network, with MaRS Innovation (Ontario) and the Centre for Drug Research and Development (BC) excellent exemplars. Current Tri-Council initiatives—CIHR’s Strategy for Patient Oriented Research (SPOR) – see above—and CIHR’s joint initiative with the Natural Sciences and Engineering Council (NSERC)—the Collaborative Health Research Projects (CHRP) already align with the concept. Additional infrastructure support could come from a realignment of portions of the Regional Diversification programs, Canada Foundation for Innovation, Genome Canada and SR&ED programs.

Toward this end, Research Canada recommends:

RECOMMENDATION 2: Budget 2012 supports an increase in Tri-Council base budgets to a level that will ensure ample support for programs that enhance research implementation (e.g. CECRs, CHRP).

The mandates of the proposed CCN would be:

- Enabling enhanced information and technology flow between regional centres.

- Bundling novel technologies from across Canada.

- Facilitating, through private sector partnerships, the establishment of seed funding to support Series A and B development of early technology and new company start-ups.

While it is beyond the scope of this submission, it is underscored that an essential component of the proposed CNN would be a national grid of enabling policies and legislation—SR&ED and harmonization of IP policies with international jurisdictions.

Toward this end, Research Canada recommends:

Recommendation 3: Budget 2012 supports the creation of a Canadian Commercialization Network (CCN) which aligns current federal funding instruments to enhance research implementation and that will be the engine of regional small business creation and will partner with the industrial sector, U.S. NCATS and EU initiatives.

Conclusion

The overarching thrust of this submission is the need to contemplate a two-pronged approach towards achieving a sustained economic recovery in Canada, the creation of quality sustainable jobs and a balanced budget. First and foremost the Government of Canada must ensure the commercialization pipeline remains rich and deep by committing to and sustaining the upstream investments in discovery research and balancing its investments in infrastructure, operating grants and salaries so that Canada can capitalize on past material investments and enhance current and future ones.

Second, Canada must address the challenges at the “front end” of the system by making a paradigm shift in how we think about building a strong and sustainable economy in this country. If we are to capitalize on accelerating the transition of technologies into start-ups and SME creation, a realignment of federal investments in health research is in order: One that results in the creation of a Canadian Commercialization Network (CCN) that would be the engine of regional small business creation and positioned to partner with the Industrial sector, US NCATS and the EU initiatives. This will be a bold and necessary move to ensure Canada’s economic prosperity into the future.

Appendix One

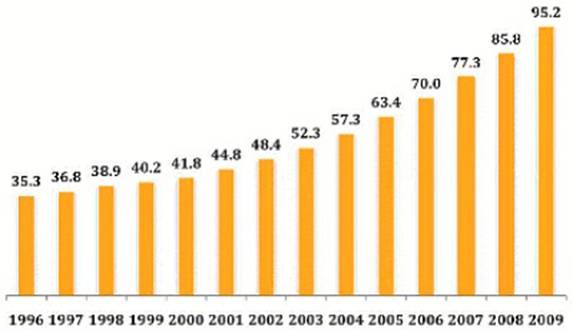

The EU's newly released Global Industrial R&D Investment Scorecard for 2009 reports an overall increase in R&D spending in the bio-pharmaceutical sector. The gains reflect activity mainly in Japan with a 26.5% increase compared with lowly increases of 2% and 1.8% respectively in Europe and the U.S. This R&D lift results mainly from new mergers and acquisitions reflecting a hefty appetite for biotech acquisition.

Global R&D Spending, 1996-2009

Source: Kalorama Information

FierceBiotech analysis of the top 15 global pharma R&D budgets, click below for details.

1. Roche - $8.7B

2. Pfizer - $7.4B

3. Novartis - $7.06B

4. Johnson & Johnson - $6.66B

5. Sanofi-Aventis - $6.25B

6. GlaxoSmithKline - $5.59B

7. Merck - $5.58B

8. Takeda Pharmaceuticals - $4.64B

9. AstraZeneca - $4.23B

10. Eli Lilly - $4.13B

11. Bristol-Myers Squibb - $3.48B

12. Boehringer Ingelheim - $3.03B

13. Abbott Laboratories - $2.61B

14. Daiichi Sankyo - $1.89B

15. Astellas Pharma - $1.63B

This market segment (“other manufacturing” category Figure 3 BERD Intensity Gap by Sector US and Canada 2003, Expert Panel Consultation paper) has the most significant intensity gap at 0.259, with pharmaceuticals contributing 0.081. Small companies with less than 100 employees currently represent 40% or 5.6 million members of the Canadian workforce (data source http://www40.statcan.ca/l01/cst01/labr75h-eng.htm).

* This section summarizes the document and serves as an Executive Summary.

[1] The six organizations are: the Association of Canadian Academic Healthcare Organizations (ACAHO); the Association of Faculties of Medicine of Canada (AFMC); BIOTECanada; Canada’s Research-Based Pharmaceutical Companies (Rx&D); the Health Charities Coalition of Canada (HCCC); and Canada’s Medical Device Technology Companies (MEDEC).

[2] Council of Ontario Research Directors/Ontario Health Research Alliance Baseline Information Survey 2003 (CORD), p. 8.

[3] 1) Health promotion and disease prevention; 2) Disease management and cure; 3)Extracting economic benefits where ever applicable from activities that achieve #1 and #2

[4] The Health Research Advocacy Network, Health Research: An Investment in Canada’s Well-Being, January 2003, p. 16